Crafted a Full-Funnel Amazon Advertising Plan for A New Product Launch & Multi-Product Regimen

What We’re Celebrating:

Thanks to our full-funnel strategy that slowly pivoted dollars toward upper-funnel tactics over time through a test-and-learn process, we helped our client increase their monthly shipped cost of goods sold (COGS) by +99%, average weekly organic branded searches by +28%, and new-to-brand (NTB) % of purchasers by +8 percentage points.

We improved our client’s Brand Metrics within their new product launch’s sub-category, increasing their percentiles across awareness, consideration, and purchase.

Overview:

GO works with a Beauty brand that was launching a new product and wanted to promote a multi-ASIN regimen, but they were working on a limited budget in a highly saturated category. On top of having a smaller advertising budget, our client needed guidance to understand how the right Amazon tools and insights could unlock new opportunities and create the results they were looking for, including:

Consistent and immediate sales growth for their new product

Increased basket-building with their regimen products

Upped new-to-brand traffic and purchases

Greater relevance within the category

Working with an Amazon Account Executive (AE), we shared data that proved the value of Amazon ad tools, particularly upper-funnel tools, with our client and identified which tactics would aid them most in hitting their goals. Once we found these tactics, we developed a full-funnel strategy that involved a gradual reallocation of dollars and a test-and-learn process to help our client improve their performance throughout the consumer journey.

The Challenge:

The client had fewer ad dollars in comparison to their competitors, making it difficult for them to stand out in their crowded space.

The client wasn’t yet convinced of the impact that Amazon advertising had on the consumer journey.

The client had been particularly hesitant to invest in upper-funnel tactics because the lack of omnichannel data cast doubt on the interconnectivity between Amazon advertising performance and brick-and-mortar sales.

The Strategy:

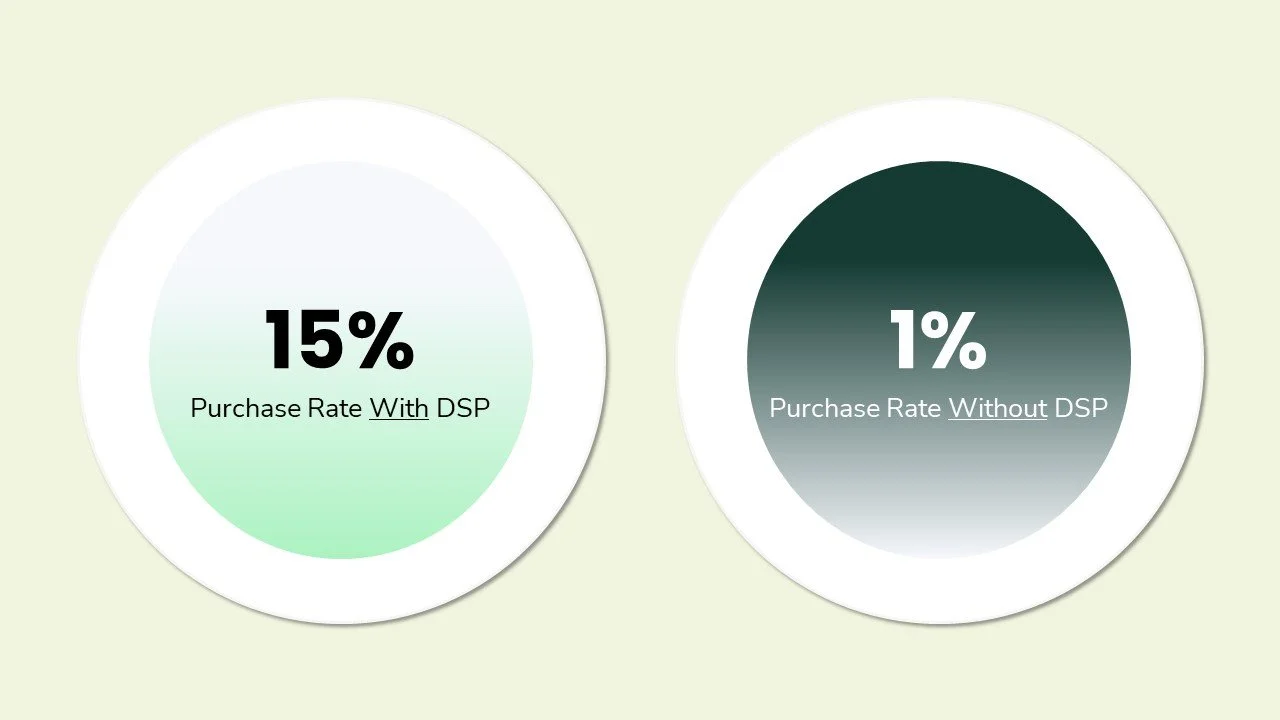

We coordinated with an Amazon AE to utilize data sets including Brand Metrics, Amazon Marketing Cloud’s Overlap Reporting, and offline sales reports. This showcased the opportunity across the funnel within our client’s category, the impact of upper-funnel tactics like Streaming TV (STV), DSP’s effect on purchase rate, and the connection between Amazon advertising & brick-and-mortar sales. This helped us level-set our campaign recommendations for the client, giving them concrete insights that supported our full-funnel strategic plan and making them more confident in Amazon advertising's impact on the entire consumer journey.

Once we shared this data and got client approval, we enacted a full-funnel strategy that addressed the brand’s investment concerns by slowly pivoting dollars toward upper-funnel tactics through a test-and-learn process. Here’s a month-by-month look at how we implemented this:

Month 1:

Integrated the new product launch into existing Sponsored Product (SP) & Sponsored Brand (SB) ads that reached loyal brand shoppers.

Utilized SP and Sponsored Brand Video (SBV) campaigns to target relevant category terms and improve new customer acquisition.

Month 2:

Leveraged Sponsored Display (SD) to target our client's own product detail pages (PDP) with the new product launch.

Used Sponsored Display Video (SDV) to retarget past purchasers and promote the new product launch.

Utilized SB to target category terms and showcase the multi-product regimen.

Sent Customer Engagement emails within the Tailored Audience Beta to share the new product launch with a 360K-repeat-customer audience.

Shared Amazon Posts weekly to increase visibility for the new product launch.

Month 3:

Implemented a test-and-learn process for STV, working with Amazon to create a 30-second video spot and tracking success through branded searches & NTB purchases.

No New Implementations in Month 4

Month 5:

Launched an Online Video (OLV) campaign to build off the success of the STV campaign. Within OLV, we A/B tested the 30-second spot against a 15-second spot to see which performed better, and the 30-second spot had an 83% higher branded search rate.

Utilized the 15-second spot on the brand’s social media to drive external traffic to Amazon.

Sent regimen boxes to affiliates and influencers with a QR code that drove traffic to the Brand Store.

Month 6:

Leveraged SBV and SD to target branded keywords and PDPs of similar or relevant products to present in-market customers with the new product launch.

Used SBV to target category terms to advertise the regimen and drive traffic to the Brand Store.

The Results:

From Month 1 through Month 6, we saw a +99% increase in monthly shipped COGS

When comparing Month 1 to Month 6, we saw:

A +28% increase in average weekly organic branded searches

NTB percentage of purchasers within their category grew from 37% to 45%

We also improved Brand Metrics within the new product launch’s sub-category:

Awareness

Month 1 = 31st percentile

Month 6 = 59th percentile

Consideration

Month 1 = 32nd percentile

Month 6 = 61st percentile

Purchase

Month 1 = 41st percentile

Month 6 = 62nd percentile

We were able to achieve these strong results for our client while spending 100% less than their peers throughout the duration of the campaign.

Want to experience growth on Amazon?

Our GO team can help you. Whether you have budget limitations or aren’t yet convinced of the impact of Amazon ad tools, we have experience developing effective, custom-built, full-funnel strategies for all our partner brands, no matter their constraints. Contact us today.